U.S. Economic and Market Highlights

THE ECONOMY

- The U.S. economy showcased robust growth, surpassing Q2 expectations despite eleven Federal Reserve rate increases since early last year to 5.5%, the highest level in 22 years. With a GDP rate of 2.4%, expansion was fueled by strong consumer spending and a low, steady unemployment rate of 3.6%, which is the same as it was early last year when rate increases began.

- Federal Reserve interest rate increases have effectively reduced the inflation rate in the U.S., which decreased to 3.2% in July. This is a decrease of 6% from the 9% rate last summer. Forecasts are for 2.5 – 3.0% by the end of 2023 and 2% inflation rate later in 2024.

- However, higher interest rates present some long-term challenges from higher borrowing costs that will diminish other investments and economic growth (monetary tightening) coupled with pressure on governments to cut social spending (fiscal tightening) to ease the level of deficit spending that was needed during the Covid-19 crisis and recovery.

- The Institute for Supply Management (ISM) indices suggest weaker growth ahead. ISM manufacturing employment gauge in the U.S. is at the lowest level in three years, which indicates there is risks toward a softening in the manufacturing sector.

- The Eurozone economy grew by 0.3 percent in Q2 of 2023 after a flat first quarter, slightly surpassing market consensus. Europe is grappling with a technical recession and high inflation. France and Spain demonstrated sustained growth rates, whereas Germany’s economy stagnated, and Italy unexpectedly experienced a contraction.

- Indonesia and Philippines experienced moderate growth in Q2, with expected GDP growth of 4.7% and 5.6% year-over-year, respectively. However, trade data shows that exports in the Asian region are struggling amidst weak global demand. Overall, emerging markets are projected to grow below trend at 3.25% annualized in the second half of the year as developed markets’ growth rates slow toward a halt.

- China grew at a 6.3% annual pace, slower than the 7% forecasted due to Covid-19 impacts, property sector struggles, and regulatory shifts. Deflationary pressure and currency weakness has led to lackluster private sector confidence and limited capital improvement spending since reopening from Covid restrictions.

FIXED INCOME

- Last week, Fitch credit rating agency downgraded the United States’ long-term credit rating from AAA to AA+. Fitch cited that they expected fiscal deterioration over the next three years and a high and growing debt burden. Unlike in 2011, when U.S. sovereign debt was last downgraded, few financial contracts and collateral are impacted by the downgrade because of many contracts were rewritten since then that removed references to specific ratings.

- U.S. 10-Year Treasury yield rose above 4% in part because of the U.S. sovereign credit downgrade and the U.S. Dollar strengthened against other currencies. The strength of the USD is likely to be influenced most by the Federal Reserve’s expected next move. At the moment the Fed is on hold after having raised another 0.25% in July.

- Bond prices generally decline when rates in the market increase. Investors are attracted by the high yields, lower corporate bond prices, and the comfort that debt securities generally provide safety amid equity risks. Credit markets rallied, with high-yield corporate bonds leading, and emerging market bonds showing promise.

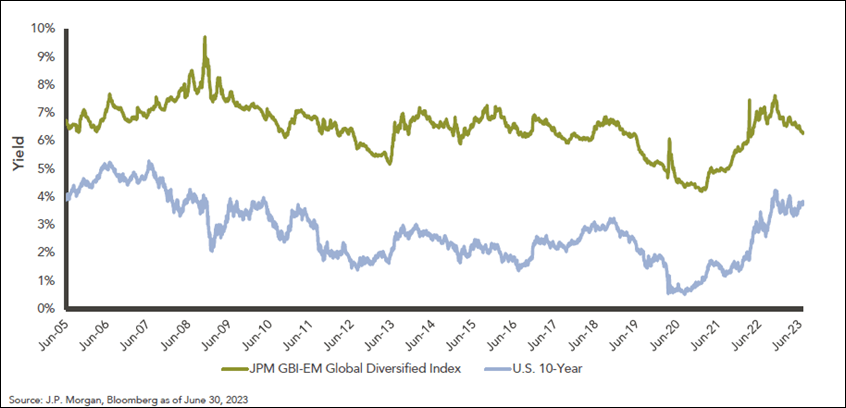

- Emerging markets are not immune to higher inflation, higher interest rates, and geo-political risks. But local emerging market debt looks attractive with higher yields relative to developed markets (see chart below), while many emerging market Central Banks are at or nearing the end of their tightening cycles, providing a possible tailwind for the asset class.

EQUITIES

- U.S. equity market prices continued to rise mid-year and transitioned to a new bull market (+20% from recent market lows), driven by tech stock gains. The sustainability of increased stock prices is being questioned by some analysts as the headwinds of higher interest rates and slowing economic growth continue.

- U.S. companies’ have a higher average Price-to-Earnings (P/E) ratio than companies in other stock markets, meaning that stock prices are higher in the U.S..

- The ‘Magnificent-7’ group comprising of Apple Inc, Amazon.com Inc, Alphabet Inc, Meta Platforms Inc, Microsoft Corp, NVIDIA Corp, and Tesla Inc has an aggregate forward P/E of 33.2x, a 73% premium to the S&P U.S. Stock Index.

- S&P 500 gains have become increasingly concentrated in a handful of tech stocks, surpassing levels seen in the 2000s tech boom. Potential productivity improvement from AI was one main driver of returns and support for stocks in Q2 and July.

- Stocks run the risks of a downturn because of increasing investor complacency ahead of an expected deceleration in the business cycle in the second half of the year. The impact of monetary tightening works with a lag. Also, certain growth supports are waning, such as excess savings and strong corporate earnings. This is especially so in the Eurozone, where central banks are not finished tightening interest rates.

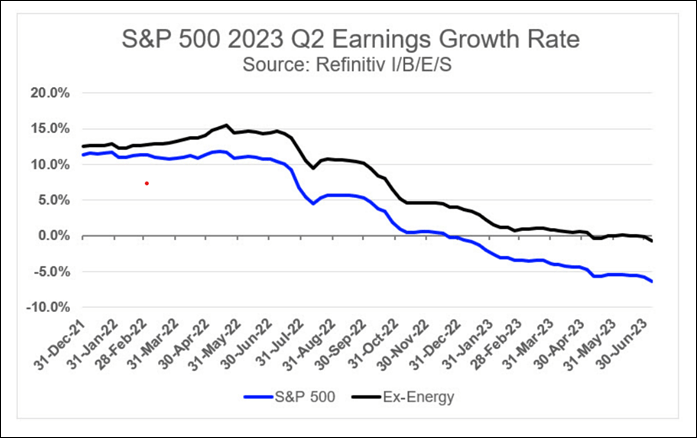

- 2023 Q2 Earnings Growth Rate is trending downward. The declining earnings growth rate trend from large-cap companies was negative when factoring in the energy sector and ex-energy companies.

- Investors have willingly accepted the “Goldilocks” economy as Central Banks’ continue working toward lower inflation, stock prices have rebounded, bond prices and yields are attractive, and the potential to evade a recession or achieve a soft landing remain a feasible scenario.

This communication was prepared for informational purposes only and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security/instrument or to participate in any trading strategy. Past performance is not indicative of future results. See below reference sources used in preparing the above information.