U.S. Economic and Market Highlights

The Economy:

- Central Banks left interest rates and bond purchasing stimulus programs in place for the foreseeable future on estimations that inflation increases will level off, economic growth will continue to rebound, and unemployment will continue to decrease.

- The economic recovery is at an important transitional phase as the Delta variant threatens to force more restrictions while inflationary pressures persist with an insufficient labor supply, uneven economic growth, commodities price increase, and rising shipping costs.

- European Union officials removed the U.S. from the (Covid) safe list of countries and recommended to EU nations reinstate nonessential travel restrictions on travelers from the U.S. because of rising coronavirus infections there. This reverses their advice in June when the EU lifted restrictions on all U.S. travelers.

- The U.S. Dollar exchange rate with the Euro has been just under $1.20 → €1.00 over the last quarter. The USD will likely strengthen versus the Euro if the Fed accelerates its decision to increase short-term U.S. interest rates or reduce (i.e. taper) its bond purchasing program. The Fed’s narrative has varied back and forth from being dovish to hawkish to dovish again in recent weeks.

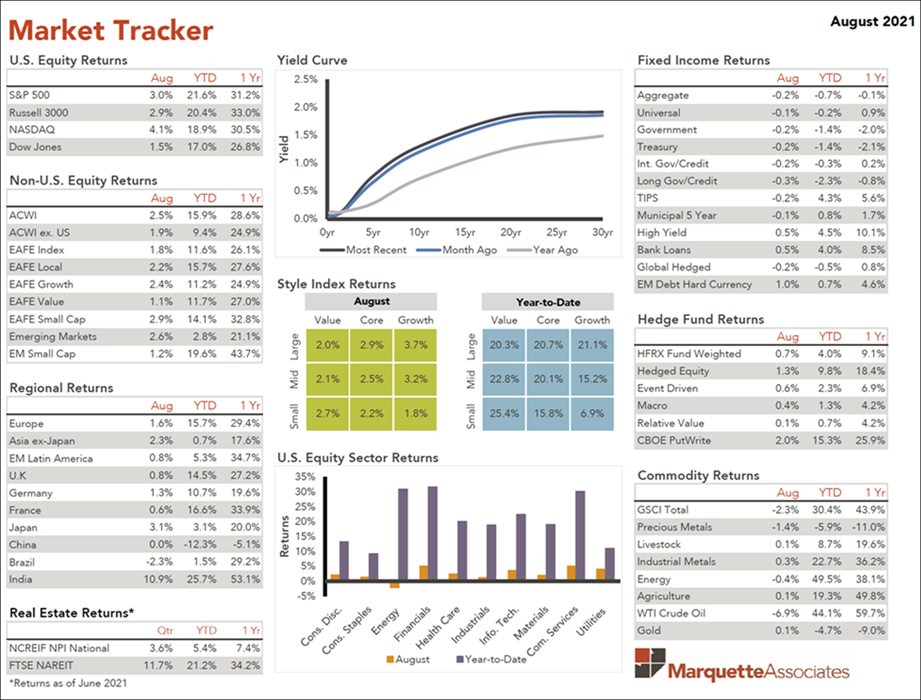

Fixed Income:

- Rates of return in most fixed income categories are slightly negative year-to-date as interest rates have been trending higher. Exceptions are high yield, inflation protected, and tax-exempt bonds.

- High yield bond issuances in August were near record setting numbers as fixed income investors increased their risk appetite in an effort to capture more yield by taking on more risks.

- High yield bonds are issued by a diverse group of companies including start-up companies (rising stars), former investment-grade companies who were downgraded by rating agencies (falling stars), high-debt and capital-intensive companies, leverage buy-out and private equity companies, and foreign enterprises.

- Manufacturing companies top the list of high yield bond issuers at 32% of the total issuances.

Equities:

- US equities reached new highs again and European share prices rose in August.

- Larger, growth-oriented stocks exhibited continued strong performance, while most small-cap equities have struggled to regain positive momentum since early June.

- Emerging market returns were positive in August, but negative for the quarter ending August 31st. The largest industry sector is Information Technology with more than 20% of total market weight.

- China is the largest country in the emerging market index with over 30% of the total weight. China makes up of only 3% of the global equity market index.

- The Chinese Communist Party has increased regulatory actions against various sectors and industries in China including anti-trust, financial services, data security, gaming, high-tech, and social issues-related regulations.

- The result of the increased regulatory environment in China has been a sell-off of stocks as investor concerns increased. The Chinese equity market index was down close to 12.3% YTD, underperforming the ACWI ex. US Index, which was up 9.4%.

This communication was prepared for informational purposes only and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security/instrument or to participate in any trading strategy. Past performance is not indicative of future results.