U.S. Economic and Market Highlights

THE ECONOMY

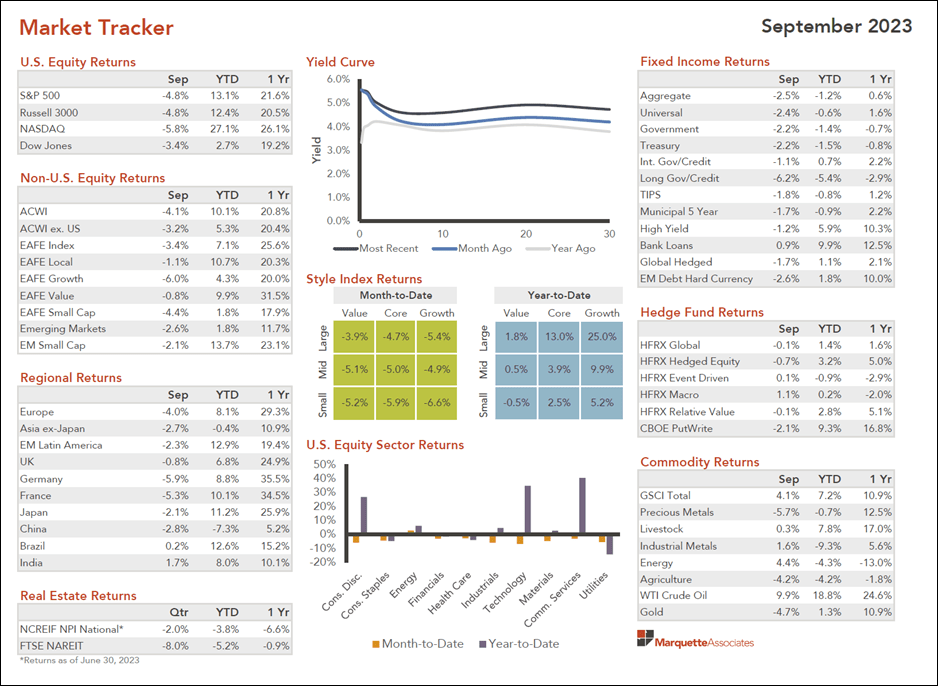

· Resilient U.S. consumer demand is putting disinflation progress at risk, raising the need for either additional interest rate hikes, or a sustained period of high interest rates. Hawkish narrative from the Federal Reserve contributed to an increase in the long-term U.S. Treasury Bond rate and a selloff in the equity and bond markets in September. (See Market Tracker below.)

· Oil prices climbed above $90 per barrel in September mainly driven by supply cuts from both Saudi Arabia and Russia. The surge in oil prices adds to the inflationary pressures that central banks have been battling around the world with continued interest rate hikes in some countries.

· Higher gas and food prices and more credit card debt are the primary reasons that the Consumer Confidence Index is down for the second straight month. The short-term outlook for income, business, and labor market conditions declined for the second month in a row.

· Current levels of government support and wage growth have helped to minimize the negative impact of continued inflation on consumers. More disposable income and household savings are available to the average consumer to mitigate consumption losses and reduce mortgage default rates to a relatively low 3.37%.

· A downside to increased government spending is that rising interest expenses increase the debt service cost portion of the federal government’s budget. About 70% of the budget is dedicated to mandatory programs, so there is very little to cut as debt service costs crowd out other government programs.

· In the Eurozone, the labor market remains very strong despite economic headwinds. The unemployment rate in the eurozone continues to hover around 6.5%. Spain, France and Italy all saw unemployment tick down, while countries with very low unemployment rates like Germany and Netherlands experienced a stable unemployment rate in August.

· The demand for employment has been slowing, especially in manufacturing. Employment in the service sector has held steady. Further weakening in the job market is expected in the months ahead.

· The strong U.S. Dollar versus other major currencies is likely to continue as long as the Fed retains an aggressively tight monetary policy. The Euro and Asian currencies may not rebound against the USD until the pace of economic growth in the regions become more aligned. Currently, growth rates in Europe and China (adjusted) are lagging the U.S.. The exceptions are the Mexican peso and Brazilian real whose values are up versus the USD.

· Most analysts believe that inflation rates will continue to subside and that by 2024 inflation will have sunk close to the Fed’s 2% target.

FIXED INCOME

- U.S. Treasury yields climbed in September to a 15-year high of 4.67% dampening price values of current bonds at lower rates but offering buying opportunities with a higher coupon not seen since 2007.

- The higher yields resulted in negative returns for both stocks and bonds in September, with increased investor concerns about the long-term impact on the overall economy from having higher interest rates for longer.

- Possible negative outcomes from an extended period of higher interest rates include a recession (negative economic growth), more risk of credit downgrades and defaults, and higher borrowing costs putting additional financial stress on individuals, businesses, and governments.

- With rising rates on the long end causing negative price volatility, the investments that have performed the best recently are high quality, short-term fixed income investments that have experienced higher coupons with less volatility.

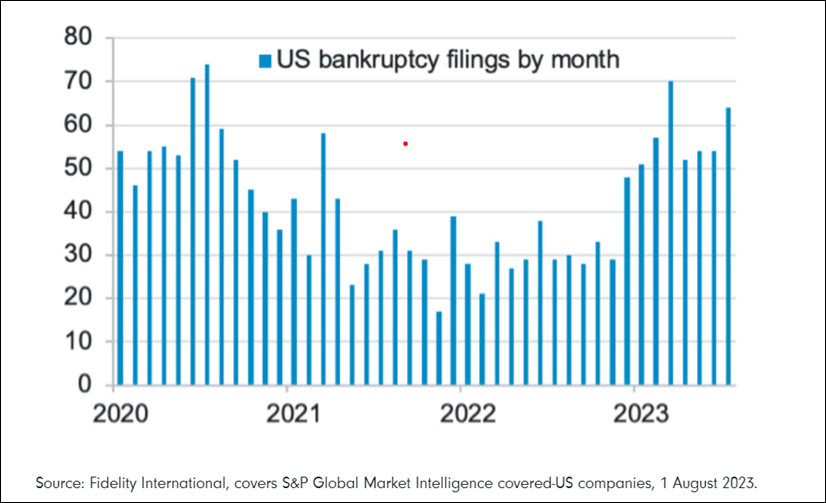

- Corporate default rates increased in August as investment grade bonds showed more stability than high yield bonds in the rising rate environment.

- European banks have been slower to raise interest rates on interest bearing deposit accounts. Consequently, European banks have been generally more profitable than U.S. banks and have outperformed other sectors who have experienced compressed profit margins due to higher costs.

- Commercial real estate, especially the office sector, is experiencing valuation declines due to high vacancies in the office sector because of the relatively large percentage of employees working remotely. A secondary stress point is higher interest rates on loans. The impact of these trends is a reduced number of transactions and negative investment returns in commercial real estate. The ripple effect is likely to be reflected in the loan portfolios at commercial banks and other lenders to commercial real estate owners.

- The average 30-year mortgage rate rose to 7.41%, its highest point since 2000. U.S. home prices remain near record highs as low supply and elevated borrowing costs have driven home affordability to the worst levels since the 1980’s.

- Emerging market sovereign debt (local currency) bonds in countries with disciplined Central Banks are positioned to benefit from a reversal to lower interest rates and a lower USD when the Fed shifts to a less hawkish policy as the economy slows in the coming quarters.

EQUITIES

- The S&P 500 was up 13.1% so far in 2023, even with the recent stock market pullback. The S&P 500 was down 4.8% for the month and down 3.7% for the quarter ending September 30th.

- Equity markets pulled back over the last two months because of investor concerns that Central Banks’ efforts to fight inflation will extend too long and push the economy into recession rather than achieving a soft landing as intended.

- European stocks have performed well but face new challenges as the European Central Bank keeps rates higher for longer, tightening into a slowdown. Australia is more likely to achieve a soft landing as the Reserve Bank of Australia’s tighter monetary policy has been less restrictive.

- China’s debt and property woes have worsened, with the government showing little signs of coming to the rescue. The restrictive government policies in China and tense trade and geo-political relationships with the U.S., E.U. and its Asian neighbors have hindered the recovery of China’s economy and markets.

- Other Emerging Market (EM) economies appear to have the potential to outperform developed markets in the coming years. As EM countries experience demographic, economic, productivity, and sustainability (ESG) growth equity market performance is projected to outperform.

- The potential negative impact of a recession on EM countries is mitigated by the proactive approach by EM Central Banks to raise and lower interest rates ahead of the larger, developed countries’ Central Banks.

- Much of this year’s equity return has been driven by a handful of mega-cap stocks in the “tech-plus” sectors including technology, communications, and sectors who are most likely to benefit from the adoption of artificial intelligence (AI) advances.

- The fourth quarter has historically been the most favorable to equity investors.The sustainability of increased stock prices is being questioned by some analysts as the headwinds of higher interest rates and slowing economic growth continue.

- Long-term investors use diversification to mitigate risks while at the same time remaining invested in risk assets (e.g., equities) to participate in the upside potential of long-term asset compounding value appreciation. One benefit from higher interest rates is that investors are able to earn interest on short-term, interest-bearing bank accounts and fixed income investments.

This communication was prepared for informational purposes only and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security/instrument or to participate in any trading strategy. Past performance is not indicative of future results. See below reference sources used in preparing the above information.