Economic and Market Highlights

The Economy

- The International Monetary Fund (IMF) projects global GDP growth at 3.3% for both 2025 and 2026, slightly below the historical average of 3.7% from 2000 to 2019. This forecast includes an upward revision for the United States, offset by downward adjustments in other major economies.

- The probability of a near-term recession in the U.S. has fallen over the last several quarters. But the U.S. budget deficit, interest expenses, and total debt are expected to remain elevated for years to come.

- In December 2024, the U.S. labor market payrolls increased with notable gains in health care, government, and social assistance sectors. The unemployment rate remained steady at 4.1%.

- The Consumer Price Index (CPI) rose 2.9% year-over-year in December, up from 2.7% in November. Core CPI, which excludes food and energy, increased by 3.2% over the last 12 months, indicating elevated levels of inflation persists.

- The Eurozone’s economic growth is anticipated to reach only 1% in 2025, a 0.2 percentage point downgrade from previous estimates. This adjustment is attributed to persistent weaknesses in manufacturing and exports, alongside political and fiscal uncertainties in key member states. Notably, the Polish economy expanded by some 2.7% and growth was close to expectations unlike the negative surprises seen in the other European countries, including Germany, whose GDP is expected to expand by 0.3%.

- Emerging markets are projected to maintain a growth rate of approximately 4% over the next two years. However, potential increases in trade protectionism among major economies pose risks to this outlook, potentially dampening GDP growth across these regions.

- Given the strengthening of the U.S. dollar, both developed and emerging market currencies posted negative returns in 4Q. See Non-U.S. currency performance chart below.

Fixed Income

- Yield levels on fixed income investments resulted in mostly positive returns in 2024. A higher income cushion provides downside protection for investors. Although, recent increases in long-term rates created downward pressure on prices, widening spreads, and rate volatility due to near-term downside risks. (See Market Tracker below.)

- In December, the Federal Reserve lowered the target range for the (short-term) federal funds rate by 25 basis points to 4.25%. The Fed’s commitment to data-driven decisions for future rate cuts reflects a cautious approach to monetary easing.

- European Central Bank (ECB) reduced its key interest rates by 25 basis points in January 2025 continuing its trend of monetary easing. This decision aligns with economists’ expectations of further rate cuts throughout the year, potentially bringing the deposit rate close to 2% by mid-2025. ECB officials have emphasized the need for prudence in future rate adjustments due to prevailing economic uncertainties.

- Emerging markets enter 2025 with a robust fundamental backdrop, characterized by faster economic growth, stable inflation, and improving account balances. These factors are expected to contribute to positive ratings for both sovereign and corporate bond issuers throughout the year.

Equities

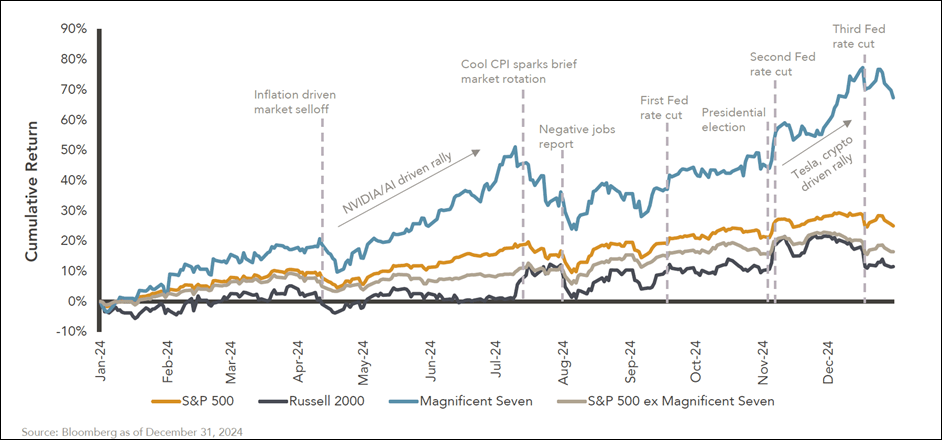

- U.S. equity market posted its second consecutive year with returns greater than 20%, as the S&P 500 Index advanced by roughly 25% in 2024. Large-cap growth equities led the market, with the top 10 S&P 500 Index holdings comprising over 37% of the benchmark. (Blue trendline shows 2024 returns for the largest technology companies.)

- Seven industry sectors posted double-digit returns across both cyclical sectors (e.g., Information Technology, Consumer Discretionary, and Financials) and defensive sectors (e.g., Consumer Staples and Utilities).

- With earnings of large-cap U.S. stocks increasing approximately 10% and returns increasing over 25%, valuations (Price/Earnings) have increased from around 23x to 27x, which is expensive from a historical standpoint.

- European equities are experiencing a divergence in performance. While some markets present opportunities due to discounted valuations compared to U.S. counterparts, ongoing political and economic uncertainties, particularly in the Eurozone, may limit upside potential.

- The outlook for emerging market equities is cautiously optimistic. Factors such as faster economic growth and stable inflation contribute to this positive sentiment. However, potential trade protectionist policies among major economies could pose challenges.

- In summary, as of mid-January 2025, the global economy exhibits signs of stabilization, with moderating inflation and steady growth projections. Nonetheless, regional disparities, particularly in Europe and emerging markets, alongside geopolitical uncertainties, necessitate a vigilant and diversified investment approach.

This communication was prepared for informational purposes only and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security/instrument or to participate in any trading strategy. Past performance is not indicative of future results.