Economic and Market Highlights

The Economy

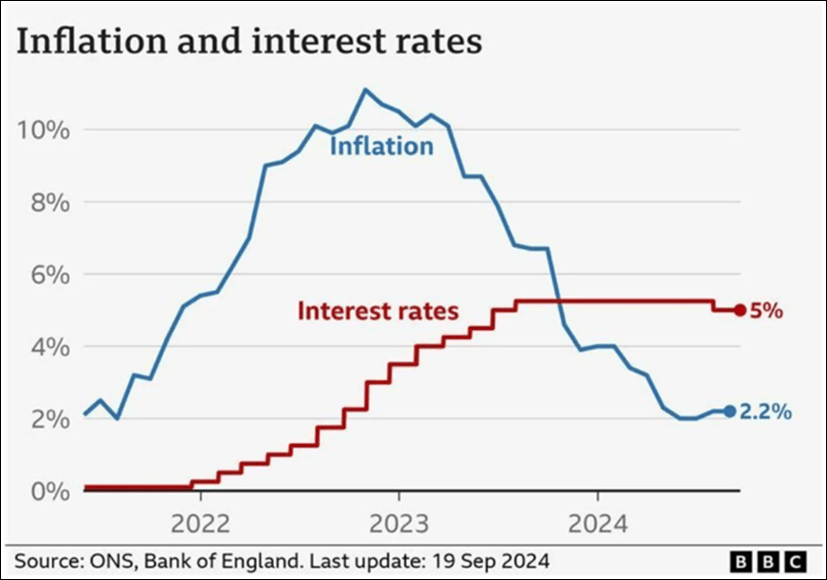

- Inflation has notably decreased from its peak of 9.1% in June 2022 to 2.5% in August, showing signs of improvement. In September inflation cooled to 2.4% in the U.S. declining slightly less than expected.

- Strong September Jobs’ Report for non-farm payrolls rose by 254k, far exceeding the 150k consensus. The unemployment rate fell to 4.1% and wages increased month-on-month.

- New jobs are concentrated in sectors like leisure, hospitality, healthcare, and government, raising concerns about the quality of full-time employment.

- Manufacturing measures remained stagnant in September, indicating no significant change, and continues to signal contraction. Manufacturing contraction continues for the 21st month in the last 22 months, one of the longest on record.

- The annualized GDP growth rate for the previous quarter was unchanged at 3.0% after a slight GDP decline in September after a sharp rise in August.

- Consumer sentiment was lower as households perceive a weakening job market, which could lead to more cautious spending, impacting growth as consumer spending makes up 70% of GDP.

- The U.S. Dollar remains relatively strong compared to other major currencies in part because of the slightly higher than expected inflation report in September.

- In September, the Federal Reserve lowered short-term borrowing rates by 0.50% (50 basis points) loosening monetary policy to encourage businesses and consumers to continue to spend and borrow.

Fixed Income

- Despite robust job data, the Fed is expected to cut rates again by 25 basis points in November, as the Fed Chairman emphasized that inflation is “much closer” to its 2% target and the labor market is “less tight” than pre-pandemic in 2019.

- Long-term interest rates rose above 4.10% in the U.S. in early weeks of October on the strength of the U.S. job data and slightly higher than expected inflation in September.

- In Europe, increased EU investment and upcoming large bond tranches from Italy and the EU are likely to result in steepening bond yields.

- In France, government bond yields rose more than other countries, having a negative market impact on current bonds because of slowing growth and divided political interests leading to social tension.

- If growth rates can remain positive and inflation continues toward a 2% year-over-year average, the European Central Bank will likely continue to gradually cut interest rates to support more borrowing and consumption.

- Lower interest rates on the short end of the yield curve and steady rates on long-term bonds supports the steepening/normalization of the yield curve.

- Corporate bond yields have dropped, signaling a strengthening in corporate credit markets, with investment-grade yields falling from 5.85% in April to 5.04%. Looser monetary policies globally are expected to further support corporate credit.

Equities

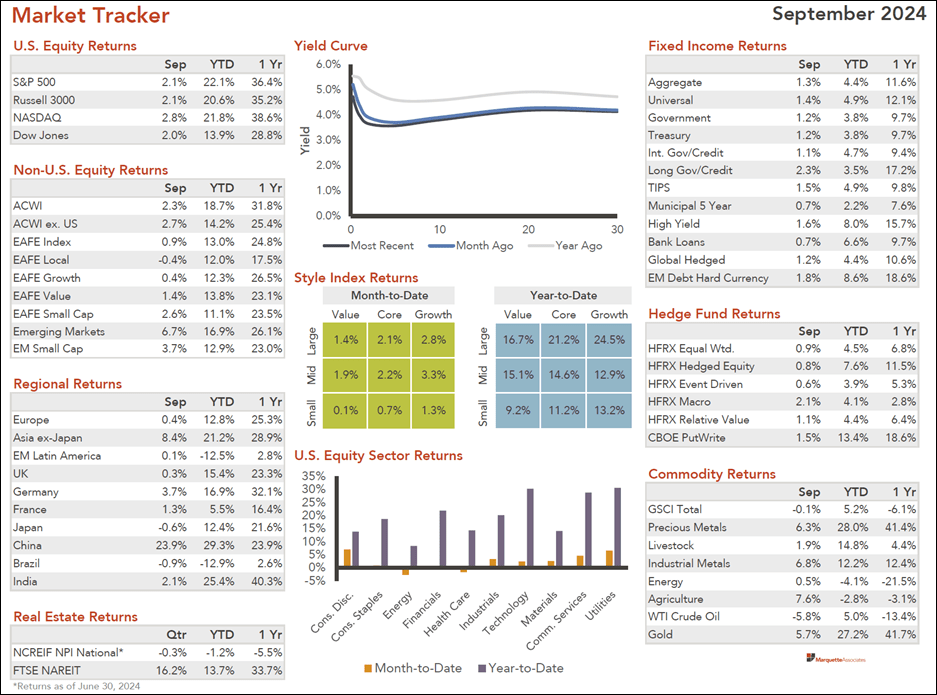

- U.S. equity markets bounced back after a sell-off in early September, driven by expectations of interest rate cuts. All major stock markets posted gains in September. (See Market Tracker below).

- Growth companies continue to outperform value stocks, but value companies have reached double-digit returns year-to-date as investors’ confidence in the markets has broadened to include sectors beyond technology and communication. One exception is energy companies and prices which have been volatile lately, and down substantially from one year ago.

- Small-cap and mid-cap stocks continue to underperform large-cap stocks but have shown more resilience lately. Both sectors have achieved double-digit returns year-to-date, buoyed by expectations of more interest rate cuts, which are expected to benefit smaller companies more than large-cap peers.

- After a series of Chinese monetary and fiscal stimulus announcements at the end of September, the Chinese stock market was up by nearly 30%, the largest one-month gain since November 2022 and the second largest in history dating back to November 2005.

- Most non-U.S. stocks have done very well this year, led by India. Also, strong gains were achieved in other Asian countries and Germany. The worst performing companies were in Latin America and Brazil, who have negative returns YTD.

- Real estate investments are expecting a return to positive results within the next few quarters as interest rates come down and prices stabilize. Commercial Office properties have struggled the most, since interest rates started climbing and post-Covid uncertainties related to more people working from home have exacerbated the recovery.

- The elections in many countries this year have created uncertainty that are sometimes disruptive to the markets. Mostly positive returns do not give evidence of market dislocations, except possibly in France, where a cohesive government is becoming difficult to organize because of different political interests leading to non-consensus.

- The outcome of the U.S. election will likely not disrupt the markets, but depending on who wins, different asset classes and market sectors should do better. If Harris wins, expect interest rates and growth to be lower, which will benefit the bond markets. If Trump wins, expect interest rates and growth to be higher, which will benefit the stock market. Much of the adoption of their individual policies will depend on the political make-up of the House of Representatives and Senate.

This communication was prepared for informational purposes only and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security/instrument or to participate in any trading strategy. Past performance is not indicative of future results. See below reference sources used in preparing the above information.