U.S. Economic and Market Highlights

THE ECONOMY

- The global economic outlook presents a mixed bag of steady progress and emerging risks. The U.S. and Europe are cautiously optimistic about rate cuts, while Asia (especially China) faces challenges in maintaining growth.

- The Fed and ECB are expected to cut interest rates in September due to cooling inflation towards the 2% inflation target. This will be the second rate cut by the ECB and first by the Fed since rates were adjusted upward in November 2021 to try to contain the rising inflation trend at that time.

- The Consumer Price Index (CPI) in the U.S. dipped in June, bringing the annual rate down to 3%, the lowest in over three years. A drop in gasoline prices helped contain inflation for the month, offsetting increases in food and shelter prices.

- Last week, the dollar took its biggest drop of the year following a soft jobs report, leading to concerns of a slowing U.S. economy. The market sold off in part over concerns that the Fed is behind the curve in its interest rate policy meant to support the economy.

- Investment in the US and Eurozone remains underwhelming post-pandemic despite demands from the defense industry, energy transition, and tight labor markets.

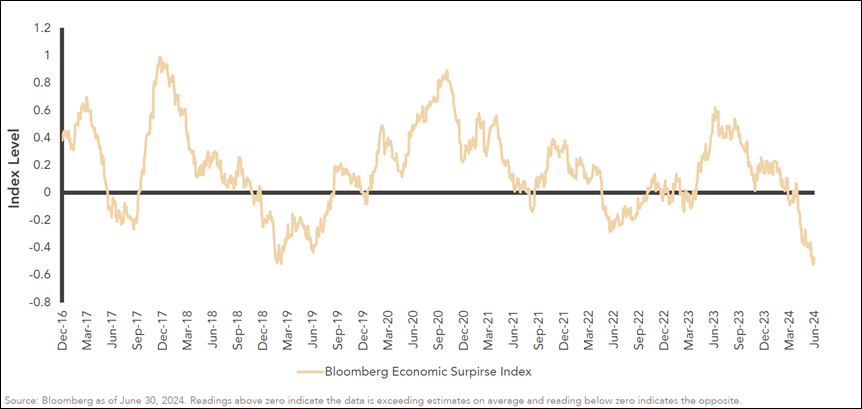

- Since the beginning of the year moderate economic growth continued. However, recent U.S. economic data have been below economists’ estimates to a degree not seen in several years. (See trend below including ISM manufacturing, services, and other data).

- Eurozone manufacturing in July contracted driven by weak activity and new orders in Germany and France resulting in slower economic growth in the Eurozone in Q2 from Q1.

- In China, GDP growth slowed more than expected, indicating weak retail consumption and strained property sectors.

FIXED INCOME

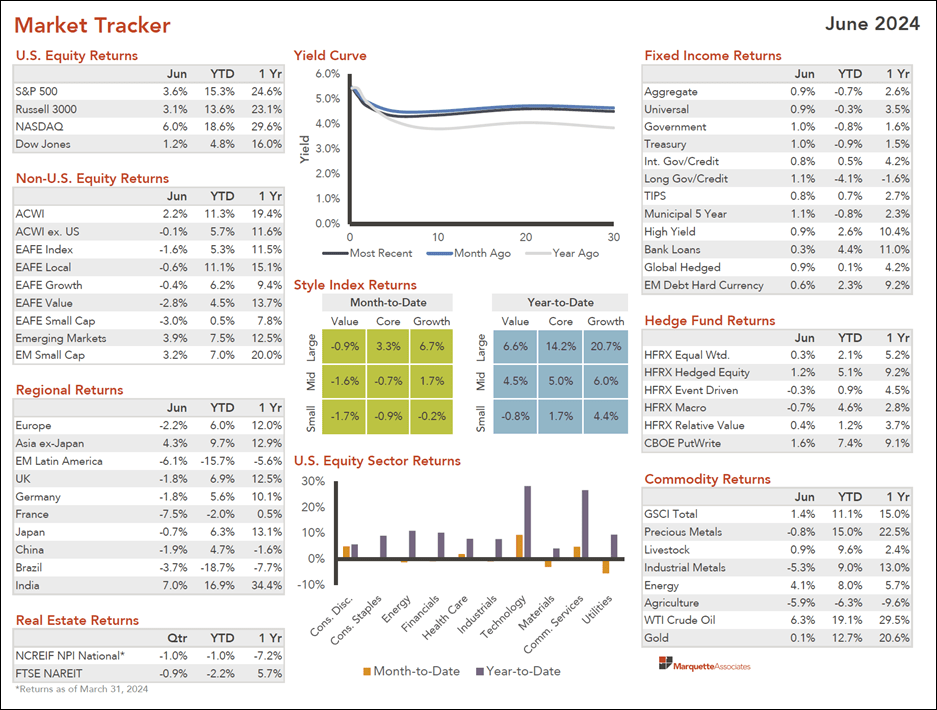

- Bonds ended the second quarter slightly positive. Yields fell, and the yield curve remained inverted, indicating potential economic concerns. U.S. Treasuries have recouped nearly all year-to-date losses given increased expectations of a near-term rate cut.

- The Federal Reserve increased rates by over 5% over the last two years. With credit tight versus long-term averages, the delayed effects of tightening are starting to make their way into the economy.

- Fixed income continues to be an attractive asset class, with high starting yields providing solid income and offering a positive expected total return over the next 12 months under the majority of interest rate and spread scenarios.

- Detriments to bond returns would beslower-than-expected rate cuts by the Federal Reserve, sticky inflation, and significant uncertainties related to the U.S. presidential election and ongoing wars in Ukraine and the Middle East.

- Accommodative legislation should increase investments, lending, and incentives for renewables, clean infrastructure, broadband, and digital infrastructure. Also, climate change, decarbonization initiatives, and the energy transition should support the continuation of non-traditional infrastructure assets/projects.

EQUITIES

- The equity risk premium narrowed to its lowest level since 2002 in the second quarter as Treasury yields rose during the period. Equity risk premium is the excess return that investing in the stock market provides over the risk-free rate (see chart below).

- The second quarter ended with continued positive momentum in large-cap US equities driven by technology and artificial intelligence advancements, although returns were less robust than the first quarter. Technology stocks, especially the “Magnificent Seven” companies, continued to outperform. (See Market Tracker below.)

- The best performing international markets (Taiwan, Malaysia, Thailand, India) have been fueled by the race to support the global use of AI, by expanding manufacturing of essential components such as semiconductors, sensors, and other electronic parts.

- Value stocks lagged larger growth counterparts. This sector dispersion globally led to negative returns in Financial, Energy, Consumer Discretionary, Industrials, and Materials sectors.

- Small-cap equity valuations relative to large cap equities remain near historic lows. Also, European equity valuations relative to U.S. equities are near historic lows. These depressed valuations are the result of geopolitical uncertainties, sluggish economic recovery in certain sectors, the overvalued U.S. Dollar, and U.S. Large-cap concentration in technology stocks.

- In time, constructive economic data, broader sector-earnings growth, and a weaker U.S. Dollar may provide a positive environment for small-cap and European equities going forward. Diversified investors should benefit as these asset classes revert over time to their historical mean/averages.

- Elections across the globe have led to market volatility this year, and that trend is expected to continue given the U.S. election in November. In addition to election uncertainty increasing market volatility, trade tensions continue to escalate between the U.S. and China, which will be a risk to monitor (particularly as companies seek to diversify and de-risk supply chains internationally).

- Institutional real estate investments have continued to be challenged by macroeconomic uncertainty, elevated interest rates, cautious lenders, and hesitant buyers. However, fundamentals outside of the (high vacancy, post-covid) office sector remain largely healthy.

This communication was prepared for informational purposes only and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security/instrument or to participate in any trading strategy. Past performance is not indicative of future results. See below reference sources used in preparing the above information.