U.S. Economic and Market Highlights

The Economy

- Eurozone manufacturing (PMI – Purchasing Manager’s Index) showed the 18th consecutive month of contraction for December, coming in at 44.4 compared to the market consensus of 44.2. A PMI reading over 50 or 50% indicates growth or expansion.

- A bounce in Eurozone inflation, due to higher consumer prices, climbed 2.9% annually, up from 2.4% previously reported, primarily because of growth in labor costs. This highlights the difficult path the ECB (European Central Bank) needs to navigate in order to get inflation in line with its 2% target.

- Economic uncertainty continues to be high. The most recent ECB decision was to keep interest rates steady at 4.5% amid fears of a eurozone recession.

- US economic growth accelerated in the third quarter at an annual GDP rate of 5.2%. The recent jobs report presented solid gains in job growth in December in government, education, healthcare, hospitality, and construction sectors, which tend to be lower paid sectors and part-time in nature.

- The US unemployment rate remained low at 3.7% with part-time employment on the rise in 2023 above 17% and full-time employment declining.

- The annual inflation rate for the US dropped to 3.1% for the 12 months ended November 2023 while wages grew by 5.2 percent.

CPI Inflation Rate versus growth of wages in the US

Fixed Income

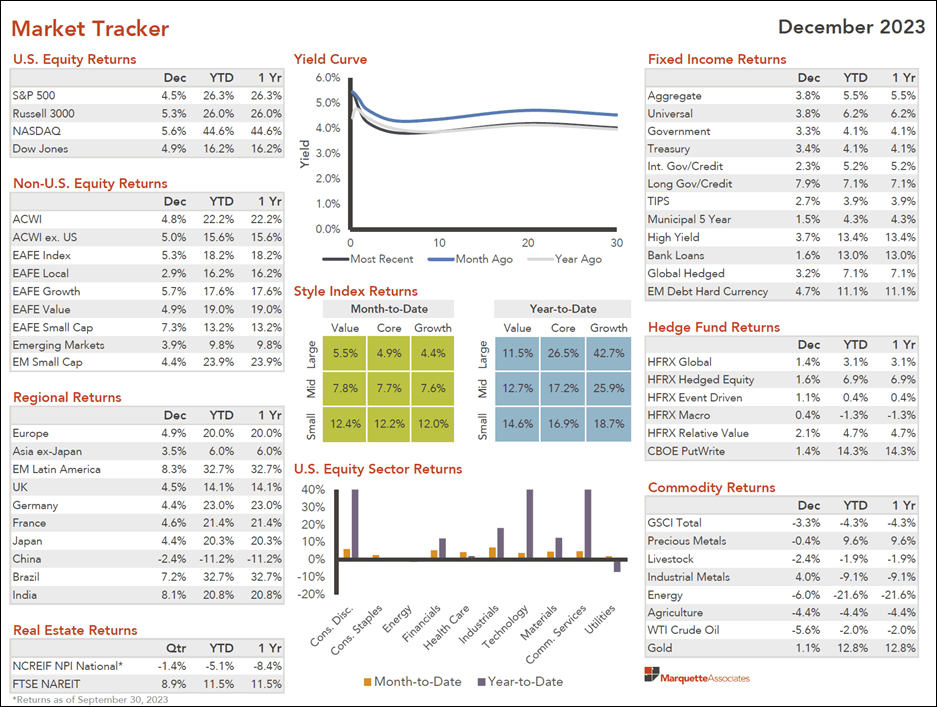

- During the fourth quarter the 10-year Treasury yields dropped almost 25% between late October and late December 2023 (from 4.98% to 3.78%, respectively) primarily because of subsiding inflation and dovish narrative from the Central Banks. This resulted in a bond market rally in the fourth quarter with the Bloomberg Aggregate Bond Index up 6.8% and bond markets ending the year with positive returns. (See Market Tracker below.)

- As yields dropped in the fourth quarter, prices rose on fixed income securities to yearly highs. Positive returns in the bond market were welcomed by investors after two years of negative returns in a rising interest rate environment.

- With the declining long-term interest rates, and the Fed rate holding at 5.25%-5.50%, the yield curve deepened its inversion. An inverted yield curve is when short-term rates are higher than long-term rates and often predicts a recession near-term. The current yield curve has been inverted since July 2022.

- In a slight reversal from the fourth quarter trend, U.S. Treasury yields climbed across the curve in early January 2024, as investors lowered expectations for the Fed to cut rates in the first quarter because of stronger than expected economic data released at the start of the new year. Now, most current estimates are that the Fed will cut rates less than 150bps (1.5%) in 2024 to try to achieve a 2% inflation target and a soft-landing and avoid a recession.

- The uncertain economic and market outlook is exacerbatedby fluctuating interest rates, above average (sticky) inflation, significant geo-political tensions, war, and mixed economic data.

- Tighter financing conditions are dampening demand, which was evident in the real estate markets over most of the last two years. Higher interest rates are having a negative impact in other subsectors such as asset-backed securities (ABS), particularly subprime auto loans, which are showing signs of weakening consumer health as the personal savings rate recently fell below pre-pandemic levels and consumer loan delinquencies continue to rise.

Equities

- Consumers continued to spend over the Christmas holiday and total corporate profits likely peaked at an all-time high in the fourth quarter. The equity market breadth broadened at the end of 2023 with almost 90% of S&P 500 companies posting positive returns.

- Most of the returns throughout 2023 were from a narrow universe of technology, communication services, and consumer discretionary companies. Growth stocks outperformed most of the year as stock prices were boosted by investors’ exuberance about the introduction of artificial intelligence (AI) into the public domain.

- Other sectors such as consumer staples, healthcare, financial, energy, and utilities (value sectors) had negative returns YTD through October and recovered in the last two months. The value sector overall ended the year up with double digit returns. The energy and utilities sectors were the worst performing sectors ending the year with negative returns.

- The U.S. S&P 500 stock index ended the year up 26.3%, European equities ended the year up 20%, and Emerging Markets equities combined ended the year up 9.8% led by Latin America and Brazil up for the year 32.7% each.

- Returns from the equity market in China ended the year down 11.2%. Recent disappointing economic data from China pertaining to slower than expected manufacturing growth adds to expectations that the government may have to add more stimulus in order to boost the struggling economy. China’s Central Bank has been lowering interest rates over the last decade and continued to lower rates (in small increments) five times in the last two years, when other Central Banks were increasing rates.

- Since the beginning of 2024, various emerging market currencies have had their worst start to a year since 1999 due to the broad dollar strength related to the recent easing of expectations for the Fed to cut rates in the first quarter 2024. Of the 30 most commonly traded currencies, 22 of them are trading lower since the beginning of the new year, led by the Russian ruble (-2.5%) and South African rand (-2.4%).

This communication was prepared for informational purposes only and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security/instrument or to participate in any trading strategy. Past performance is not indicative of future results. See below reference sources used in preparing the above information.